Working as a Freelancer in Germany

This guide covers how to operate as a freelancer in Germany. From creating legally-compliant invoices and tracking your revenue and expenses to registering for VAT and submitting your annual tax reports, we explore the ins and outs of self-employed life in Deutschland!

💻 Year-on-year, we have seen a continued proliferation of freelance jobs and projects in Germany. With companies looking for more workforce flexibility and workers increasingly keen to apply their skills in a freelance capacity, Germany’s job market is opening up and offering opportunities for self-employed professionals across a wide array of fields.

😨 But leaving the security of regular employment can be terrifying. While managing your own clients, finances and taxes can be quite daunting, this guide aims to detail what you need to know to successfully operate as a freelancer in Germany. In it, we will cover:

1️⃣ Registering your freelance activity in Germany

2️⃣ Invoicing

3️⃣ Bookkeeping

4️⃣ Income tax (Einkommensteuer)

5️⃣ VAT (Umsatzsteuer or Mehrwertsteuer)

6️⃣ Trade tax (Gewerbesteuer)

7️⃣ Church tax (Kirchensteuer)

8️⃣ Deductions

9️⃣ Banking

1️⃣0️⃣ Health Insurance

1️⃣1️⃣ Communicating with your local tax office (Finanzamt)

1️⃣2️⃣ Co-working spaces in Berlin

1️⃣3️⃣ WiFi cafes in Berlin

Note: This page provides details on how to manage your day-to-day freelance business in Germany. If you are instead needing information on how to get established as a freelancer, then check out our step-by-step guide on How to Set Up As a Freiberufler (Freelancer) in Germany.

1️⃣ Register your freelance activity in Germany

⚠️ Before your freelance work can commence, it is important that you register your freelance activity with your local tax office (Finanzamt) via a freelance registration form known as the Fragebogen zur steuerlichen Erfassung.

Importantly, you must complete and submit the Fragebogen zur steuerlichen Erfassung form in order to receive your freelance tax number (Steuernummer), which is needed before you can legally start invoicing clients in Germany. You must also use the form to apply for a German VAT number (Umsatzsteurnummer) or declare that you are a small business owner (Kleinunternehmer).

✅ The Fragebogen zur steuerlichen Erfassung form is a complex 8-page German form and arguably the most challenging obstacle to your set up as a freelancer in Germany. With this in mind, we highly recommend using Sorted’s free freelancer registration service – Sorted will guide you through the Fragebogen zur steuerlichen Erfassung form in English and even submit the completed form to your local tax office on your behalf. This is a sure-fire way to register your freelance activity correctly in Germany.

2️⃣ Invoicing in Germany

🤑 Once you have completed the necessary steps to becoming a freelancer in Germany, including applying for and receiving your freelance tax number (Steuernummer), it is time to start invoicing clients and ultimately get paid for your freelance work in Germany.

How to create legally-compliant invoices

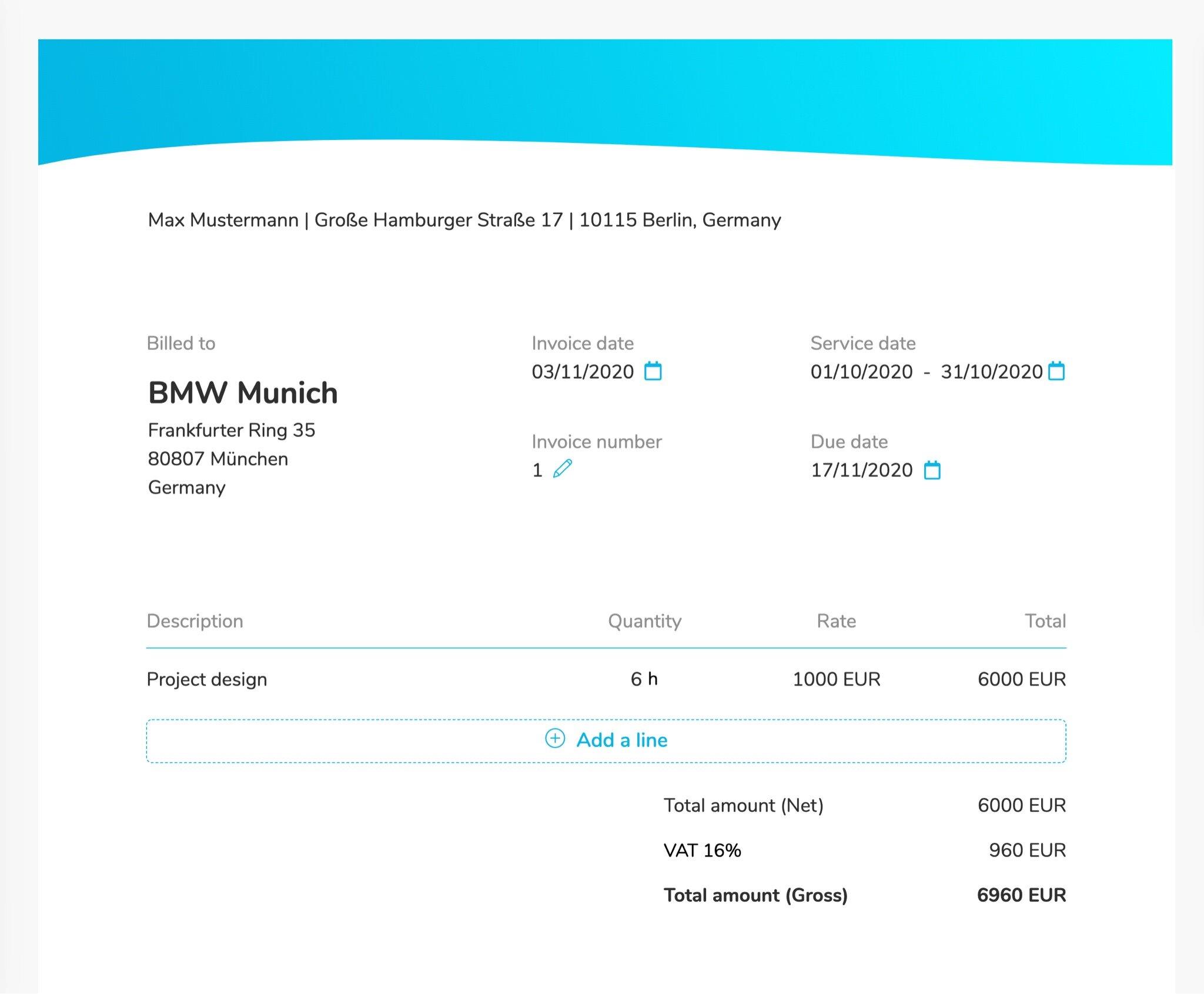

✅ Many freelancers in Germany worry about creating legally-compliant invoices. While we have provided detailed instructions below regarding exactly what you need to include in your invoices, the easiest and most reliable option is to again use Sorted. Integrated into Sorted’s free accounting and tax filing software is a fantastic invoice creation tool. This tool allows you to easily brand, share and track your invoices as well as produce professional-looking, legally-compliant invoices that tick all the boxes for the tax office (Finanzamt):

Key inclusions for German invoices

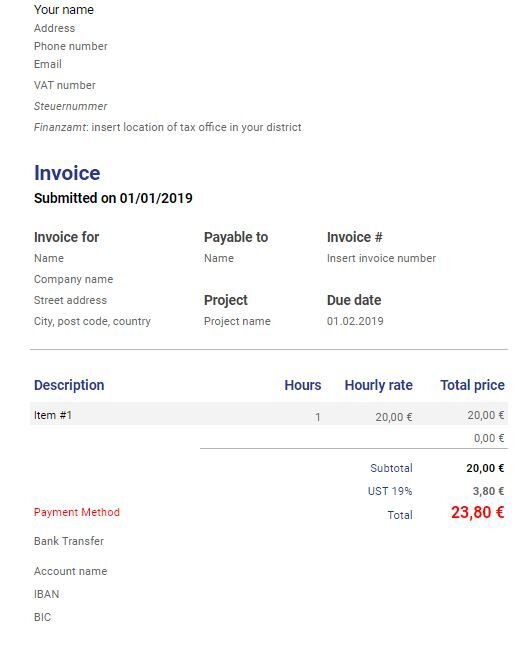

If you prefer to go it alone and create your own invoices manually, then here is an overview of what should be included in invoices in Germany:

✔️ Your name and address

✔️ Your customer’s name and address

✔️ The invoice date

✔️ Invoice number

✔️ The service provided

✔️ Payment terms and payment method

✔️ Your freelance tax number (Steuernummer)

✔️ The name of your local tax office (Finanzamt), i.e. Finanzamt Friedrichshain-Kreuzberg, Finanzamt Prenzlauer Berg, etc.

✔️ Total invoiced amount

✔️ VAT amount (if applicable)

✔️ Your VAT number (if applicable)

✔️ Customer’s VAT number (if applicable)

If you are categorised as a small business owner (Kleinunternehmer) when registering as a freelancer in Germany via the Fragebogen zur steuerlichen Erfassung form, then you are not permitted to charge VAT (Umsatzsteuer) when invoicing customers. If this applies to you, then the following sentence should be included on your invoices in German:

“Gemäß § 19 UStG wird keine Umsatzsteuer berechnet”

This is a simple declaration that you are a small business owner (Kleinunternehmer) according to Art. 19 of the German VAT Act and, therefore, VAT exempt. For further info about being exempt from paying VAT in Germany, see the section below on VAT (Umsatzsteuer).

Invoice numbers should be chronological and any cancelled invoices also need to be saved and recorded. Do not re-use an invoice number from a cancelled invoice. We recommend using the year then chronological numbers starting from 1. For example, 2021-01, 2021-2, 2021-3, etc.

Your invoices should NOT include the following

❌ Your business name – in Germany, your business name as a freelancer is your first and last name. You can use another company name for marketing purposes but not for invoicing or on any official documents.

For example, a freelance life coach called Jeremy Usbourne with a website called Happy Daily should put their name (Jeremy Usbourne) on all invoices/official documents, not 'Happy Daily'.

❌ Do not add VAT (Umsatzsteuer) to your invoices if you are not registered for VAT.

Here are a couple of template invoices with VAT excluded and with VAT included so that you know what your invoices should look like:

3️⃣ Bookkeeping in Germany

📖 The success of any freelance business is partly dependent on your handle on the finances. Single-entry bookkeeping is the most common for freelancers (Freiberufler). Here you are simply required to keep a record log of the money coming in and the money going out.

🏛️ Make sure that your invoices match your bookkeeping records and keep all original invoices and expense receipts in case you are audited by the tax office (Finanzamt) – you should keep these records for 10 years as the Finanzamt can request to see these at any time.

✅ While lots of freelancers track their revenue and expenses on a simple Excel spreadsheet, we recommend Sorted’s accounting software that allows you to enter all your income and expenses in one place – come tax season, Sorted can take your entries and automatically prepare all your tax reports for you, allowing you to then submit them to your local tax office (Finanzamt) with just a few clicks.

If your freelance finances are more complex than simply tracking your profit or loss in a simple statement (i.e., you receive rental income, money from investments, royalties, etc.), then it may beneficial to employ the services of a German tax adviser (Steuerberater) to complete your tax returns.

4️⃣ Income tax (Einkommensteuer)

Once a year, all freelancers must perform an income tax return for the previous financial year. To keep it simple, Germany’s financial year aligns with the calendar year (1st of January – 31st of December).

💸 So, once the new year rolls around, it is time to pay your dues to the taxman for the previous year. If you are completing and submitting your income tax return yourself, the deadline is the 31st of July (i.e. your tax return for 2020 would be due no later than 31 July 2021).

As of 2021, the tax-free allowance for Germany is €9,744. Up until this amount, your income is not subject to tax. However, even if you earn less than this in your first year of operation, you are still required to complete a tax return.

Once you have earned over the tax free-threshold (€9,744), your income will be taxed on a sliding scale depending on how much you earn:

€0 – €9,744 = not taxable

€9,744 – €57,918 = 14% sliding up to 42%

€57,918 – €274,612 = 42%

Over €274,612 = 45%

⚖️ To determine your taxable income, you simply add up all your freelance revenue from different sources (e.g. €30,000) and deduct any freelance expenses you have incurred (e.g. €10,000). The remainder (€20,000) is the portion of income that you need to pay tax on.

✅ If your tax situation is fairly straightforward (revenue minus expenses), we suggest using Sorted’s accounting software to help you complete your income tax return. Simply enter your revenue and expenses in the software throughout the year and Sorted will automatically generate your income tax return (Einkommensteuererklärung) and annual profit report (EÜR) – better still, you can then submit these reports through Sorted as the software is directly connected to the German tax office (Finanzamt).

📬 After your first income tax return in Germany, you will be sent a letter by the tax office (Finanzamt) instructing that you need to make quarterly income tax prepayments for the next financial year. The installment amounts are based on your most recent income tax return.

5️⃣ Value-added tax (Umsatzsteuer)

💵 Umsatzsteuer (or Mehrwertsteuer) is the German term for value-added tax (VAT). VAT is a sales tax levied on the supply of goods and services. The standard rate for Umsatzsteuer in Germany is 19% although this can be as low as 7% for certain products and services.

If you are a freelancer or self-employed worker in Germany, you will be required to charge VAT (Umsatzsteuer) when invoicing clients unless you are classified as a small business owner (Kleinunternehmer). The VAT payments that you collect from clients will then need to be passed on to the German tax authorities.

If you are required to charge VAT, make sure you clearly state the original price + VAT as separate entries on all of your invoices. For example:

You will need to obtain a VAT identification number (Umsatzsteuernummer) in order to report and pay VAT payments to your local tax office (Finanzamt). You can apply for your Umsatzsteuernummer when registering as a freelancer in Germany via the Fragebogen zur steuerlichen Erfassung form.

Which VAT declarations do I need to submit?

📅 Once you have registered for VAT, you will be then be required to submit monthly or quarterly VAT declarations (Umsatzsteuer-Voranmeldung) to the tax office as well as an annual VAT return (Umsatzsteuererklärung).

✅ While it is possible to submit these reports manually via ELSTER (the German tax office’s online portal), this is all in German and quite confusing. For a much simpler process, Sorted’s Pro Plan helps you prepare and submit these VAT reports in a simple and stress-free manner.

Small business owners (Kleinunternehmer)

In Germany, a Kleinunternehmer is a small business owner (freelancer or self-employed worker) whose annual revenue (income before deductions) is below €22,000. The small business owner regulation (Kleinunternehmerregelung) in Germany is designed to simplify tax obligations for freelancers and self-employed workers that have a low annual revenue.

Most notably, a Kleinunternehmer does not need to charge VAT (Umsatzsteuer) when invoicing customers. This not only simplifies their accounting as they do not need to collect and pay VAT but also allows them to charge considerably lower prices than their VAT-paying competitors.

✅ You can apply to be recognised as a Kleinunternehmer when registering as a freelancer in Germany via the Fragebogen zur steuerlichen Erfassung form. Rather than battle through the complex German form on your own, we recommend using Sorted's free English service to help ensure you complete the form and are successfully registered as a Kleinunternehmer.

If you are a Kleinunternehmer, you will only need to start paying VAT after your first year as a freelancer if your revenue in the current calendar year ends up being €22,000 or more, or if you expect your revenue to be above €50,000 in the coming calendar year. If this is the case, you will simply be required to start charging VAT (Umsatzsteuer) from 1 January of the coming year and you will not be backdated, i.e if you earn €25,000 in 2021, you will only be required to start paying VAT from 1 January 2022.

6️⃣ Trade tax (Gewerbesteuer)

While freelancers and self-employed workers are considered the same in many countries, this is definitely not the case in Germany. Depending on your profession, you will either be classified as a Freiberufler (freelancer) or Gewerbetreibender (self-employed). You can read more about which category your work falls into here.

🛠️ If your work falls into the self-employed business category (Gewerbetreibender), you will also need to pay trade tax (Gewerbesteuer). You can register for the trade tax at your local trade office (Gewerbeamt).

🏛️ Trade tax is levied annually and must be declared to your local tax office (Finanzamt) via a Gewerbesteuererklärung (trade tax return) along with your annual income tax return. Only profit above €24,500 is subject to Gewerbesteuer.

If you are a self-employed worker (Gewerbetreibender) and therefore subject to trade tax (Gewerbesteuer), we recommend that you employ the services of a tax advisor (Steuerberater) to help you manage your taxes in Germany.

7️⃣ Church tax (Kirchensteuer)

⛪ In Germany, Protestant, Catholic and Jewish denominations have the authority to impose a church tax (Kirchensteuer), which you are liable to pay if you indicate that you are a church member. This will amount to an additional 8–9% of your income tax.

Even if you declare that you are not a church member when registering your address (Anmeldung), you will often be sent another form from the tax office (Finanzamt) regarding your religious status after you have registered your freelance activity in Germany.

To confirm that you are not a member of a church (and thus not liable for church tax), simply tick 'No' for questions 1–4 before signing and returning the form to the Finanzamt.

8️⃣ Tax deductions for freelancers in Germany

💰 One of the benefits of freelancing in Germany is that you can considerably lower your tax bill through business-related deductions. These include costs such as:

✔️ Business travel

Transport costs

Accommodation costs

Food

✔️ Work equipment

Mobile phones, laptops, monitors

Software

Clothing

✔️ Insurances

Public or private health insurance contributions

Personal liability insurance (Haftpflichtversicherung)

Unemployment insurance (Arbeitslosenversicherung)

Accident insurance (Unfallversicherung)

Occupational disability insurance (Berufsunfähigkeitsversicherung)

✔️ Home office

Rent (only if a room is used exclusively for work)

Utilities incl. electricity, water, etc.

✔️ Office

Rent

Utility costs

Furniture

Co-working subscription

✔️ Commuting costs

✔️ Training and education

Conferences and seminars

Events

Courses (incl. relevant online courses and language classes)

Training materials (e.g. magazine subscriptions)

✔️ Professional services

Lawyers, accountants, content writers, etc.

✔️ Fees

Website fees

Bank fees

Payment solutions fees (PayPal, Stripe, etc.)

This list is certainly not exhaustive but gives you an idea of some of the operating costs you can either fully or partially deduct when completing your annual tax return in Germany. If in doubt, consult with a tax adviser – while they may cost a bit, they will almost certainly be able to reduce your tax bill.

9️⃣ Banking

🏧 When living and working in Germany as a freelancer or self-employed worker, it definitely pays to have German banking services at your disposal. This makes payments from German clients more convenient, simplifies paying taxes and ensures you have a day-to-day transactional account that meets your business needs.

As a freelancer (Freiberufler) in Germany, you are free to use your personal bank account to manage your freelance business and you do not need a separate business account.

✅ Our favourite banks for freelancers who have recently arrived in Germany are N26, Vivid and bunq. These are modern online banks that combine a quick, hassle-free sign-up process with an intuitive banking app, a free Debit Mastercard, free ATM withdrawals and nifty banking features. This makes them an ideal and convenient option for newcomers to Berlin – find out more about your banking options in Germany here or in our dedicated N26, Vivid and bunq reviews.

While an N26, Vivid or bunq account is sufficient for most freelancers, you may require more advanced banking services or have specific requirements. For this, good choices include Germany’s more traditional ‘bricks-and-mortar’ banks – Commerzbank and Deutsche Bank are two popular options with reasonable English-speaking customer support depending on your local branch.

1️⃣0️⃣ Health Insurance for freelancers in Germany

⚠️ Freelancers and self-employed workers are legally obligated to have health insurance coverage in Germany.

As a freelancer (Freiberufler) or self-employed worker (Gewerbetreibender), you technically have the option of choosing between public health insurance and private health insurance in Germany.

However, in reality, if you are a non-EU citizen and a newcomer to Germany, your chances of being accepted by a public health insurance scheme are virtually zero and even lower if you do not already have a 2-year Freelance Visa or Self-Employment Visa for Germany.

🚑 Therefore, we suggest that you opt for German private health insurance.

German private health insurance

When it comes to getting private health insurance as a freelancer/self-employed worker in Germany, we suggest the following options:

✅ Sign up for a German private health insurance policy through Feather

Feather is an English-speaking brokerage company that has a close relationship with a wide number of German insurers. You can sign up for a free consultation here – Feather will assess your situation and propose a German private health insurance that is suited to your needs. And best of all, the entire sign-up process is completely free of charge.

Having worked closely with Feather over the last year, we can assure you that you will be in very capable hands – therefore, this is our no.1 suggestion for freelancers and self-employed workers looking to get insured in Germany.

✅ Sign up for a German private health insurance policy with Ottonova

Another popular option amongst freelancers in Germany and a good alternative to Feather’s private health insurance policies is Ottonova. Ottonova is setting a new benchmark for what a modern health insurance company should look like. To sign up for one of their policies, click here.

Expat health insurance

It is common for non-EU/EEA freelancers and self-employed workers to be rejected by private health insurance providers in Germany. If, after contacting Feather and Ottonova, you are deemed ineligible for German private health insurance, you will obviously still require health insurance coverage in Germany, especially if you intend to apply for the Freelance Visa or Self-Employment Visa.

✅ As a temporary solution, we like Feather’s expat health insurance cover, which will ensure you have sufficient medical cover while in Germany and for your initial visa application. However, freelancers and self-employed workers should regard Feather’s expat health insurance cover as a temporary measure and switch to a regular German private health insurance policy as soon as possible after obtaining their visa.

For further tips, see our guide on health insurance in Germany.

1️⃣1️⃣ Communicating with your local tax office (Finanzamt)

📧 If you have any questions about the letters you receive from the tax office (Finanzamt), you can send them an email. You can also email them any questions you have about your tax return or tax-related questions and they are generally fairly helpful. Always include your Steuernummer in any email communication to the tax office. You should only contact the tax office in the district where you are registered.

Here are the contact email addresses for the different tax offices in Berlin:

Mitte (Tiegarten & Moabit) – poststelle@fa-mitte-tiergarten.verwalt-berlin.de

Friedrichshain / Kreuzberg – poststelle@fa-friedrichshain-kreuzberg.verwalt-berlin.de

Prenzlauer Berg (Pankow / Weissensee) – poststelle@fa-prenzlauer-berg.verwalt-berlin.de

Neukölln – poststelle@fa-neukoelln.verwalt-berlin.de

Wedding – poststelle@fa-wedding.verwalt-berlin.de

Charlottenburg – poststelle@fa-charlottenburg.verwalt-berlin.de

Schöneberg – poststelle@fa-schoeneberg.verwalt-berlin.de

1️⃣2️⃣ Co-working spaces in Berlin

As a freelancer, it can be difficult to feel productive when working from home in your pyjamas. Thankfully, co-working spaces are all the rage at the moment and provide perfect dedicated workspaces for freelancers.

☕ Some of these co-working spaces also offer tons of extra perks, including workshops, seminars, tutorials, social events and free coffee! If you pick the right one, you will also likely meet a bunch of other freelancers, opening up opportunities for collaboration and a general community vibe

Here are some of the best co-working spaces in Berlin to check out:

Many of the co-working spaces offer freelancers a free co-working day. Take advantage of free trial days at co-working spaces to spend the day there to try it out before paying for a full membership.

If you are instead looking for somewhere free to work in Berlin, here is a list of libraries in Berlin with public WiFi access. We recommend the Berliner Stadtbibliothek or the American Memorial Library, which both have free, fast public WiFi.

1️⃣3️⃣ WiFi Cafes in Berlin

💻 Below, we have listed laptop-friendly cafes with lots of charging points, which we think are great locations for doing freelance work.

Cafe Hermann Eicke - Prenzlauer Berg

Cafe Rhino - Prenzlauer Berg

St Oberholz - Mitte

Hallesches Haus - Kreuzberg

Betahaus Cafe - Kreuzberg

✅ We hope this guide has provided you with helpful insights into working as a freelancer in Germany. For further information about life in Germany, see our free relocation resources and blog.