Steueridentifikationsnummer vs Steuernummer: Which Tax Numbers Do I Need in Germany?

This page takes an in-depth look at two important tax numbers in Germany; your tax ID (Steueridentifikationsnummer) and your freelance tax number (Steuernummer). We explore who needs them, the difference between the numbers and how you can get hold of yours

Taxes are complicated at the best of times. When you add in a bunch of German terminologies, a multi-layered tax system and a grumpy Finanzamt worker, this can lead to a perfect storm of confusion and anxiety.

But worry not! With the necessary tax numbers at your disposal, it is possible to muddle through key tax processes without necessarily needing the help of a tax professional (Steuerberater).

When it comes to your taxes, there are two hallowed tax numbers that are integral to your financial life in Germany; your tax ID (Steueridentifikationsnummer) and your freelance tax number (Steuernummer).

We’ve taken a closer look at the two numbers below…

German Tax ID (Steueridentifikationsnummer)

For anyone looking to work in Germany, getting your Steueridentifikationsnummer (German Tax ID) should be a top priority.

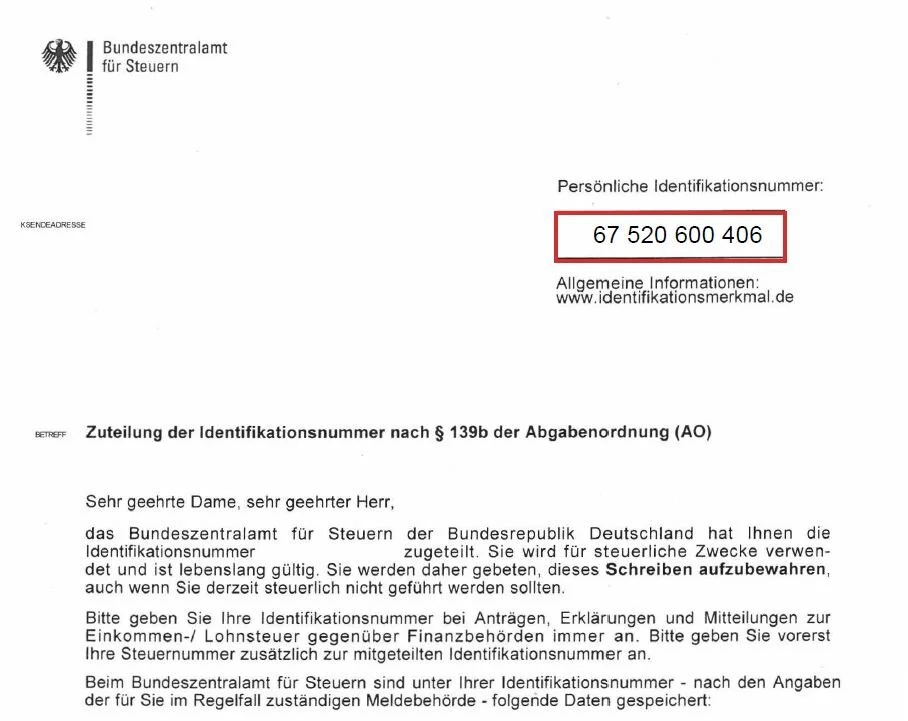

Commonly known as a Steuer-ID or Persönliche Identificationsnummer, your German Tax ID is a life-long, permanent number used by the German tax authorities to identify you for tax purposes.

Why do I need a German Tax ID (Steueridentifikationsnummer)?

Essentially, your German Tax ID is used to process everything regarding your income tax. When starting a job in Germany, your employer will need your Steueridentifikationsnummer in order to process your income tax correctly.

While it is possible to start working without a Steueridentifikationsnummer, your salary will be taxed at a much higher rate until you can provide your employer with your tax ID.

How do I get my German Tax ID (Steueridentifikationsnummer)?

Your German Tax ID (Steueridentifikationsnummer) is automatically generated once you register at an address in Germany, a process that is known as Anmeldung. Once you’ve completed your Anmeldung, your tax ID is mailed to your registered address and is usually received within 2–4 weeks.

To ensure that you receive your German tax ID in the post, it is important that you have your surname added to the letterbox at your registered address. Without this, your Steueridentifikationsnummer may be returned to sender (and you may even be de-registered from the address if the authorities mistakenly assume you no longer live there).

So that you know exactly what to look out for in the post, here is an example of the letter you will receive from the Federal Central Tax Office (Bundeszentralamt für Steuern) – your German tax ID will be shown in the box at the top of the letter (shown in red):

If you need to register at an address in Berlin but are struggling to find suitable accommodation, then you may be interested in booking a furnished apartment with Smartments. Smartments provide well-located, studio accommodation and offer Anmeldung so long as you book for at least 14 nights. By opting for Smartments, you can get registered within days of arriving in Berlin.

What happens if you lose your German Tax ID (Steueridentifikationsnummer) or it never arrives in the post?

Firstly, do not panic! If, for whatever reason, you lose your Steueridentifikationsnummer or never receive it, there are a number of ways to get hold of your German tax ID:

Request for your tax ID to be re-sent from the Bundeszentralamt für Steuern. You can do this by completing this form – it can take up to 6 weeks to receive your re-ordered tax ID in the mail.

Head to your local tax office (Finanzamt) and request for them to print your Steueridentifikationsnummer for you. Here is a useful tool for finding your local tax office in Germany.

If you are a regular employee in Germany (and do not intend to carry out any additional freelance activities), then all you need is your German Tax ID (Steueridentifikationsnummer) for tax purposes. Your employer will use the tax ID to process your income tax and your contributions will be automatically drawn from your monthly salary.

For further information about the documents required to start a job in Germany, see our guide.

However, if you plan on doing any freelance work (or operate as a full-time freelancer), then you will also need a Freelance Tax Number (Steuernummer). For further information about Freelance Tax Numbers, read on…

Freelance Tax Number (Steuernummer)

Freelancers and self-employed workers also need a Freelance Tax Number (Steuernummer) when working in Germany. The number is issued by your local tax office (Finanzamt) and is a unique identifier of you and your freelance work.

If you move district in Germany, and fall under the jurisdiction of a different tax office, then you need to apply for a new Freelance Tax Number (Steuernummer).

Why do I need a Freelance Tax Number (Steuernummer)?

In short, freelancers and self-employed workers need a Steuernummer to issue invoices and correctly process tax on their freelance income in Germany.

It is a legal requirement that your Steuernummer is shown on your invoices, and many clients will not accept invoices that do not have this all-important number on them.

How do I get my Freelance Tax Number (Steuernummer)?

To apply for a Freelance Tax Number, you need to complete a fairly lengthy 8-page form called the Fragebogen zur steuerlichen Erfassung. There are a number of good translations online to help you with the form if you fancy going it alone. Once completed, you need to submit the form at your local tax office (Finanzamt) – use this tool for finding your local tax office in Germany.

Alternatively, I suggest using Sorted who can help you complete and submit the form for free. Once completed, Sorted will even submit the form to your local tax office (Finanzamt) for you. For further info about how Sorted can help you set up and manage your freelance business in Berlin, check out our blog post.

Once submitted, you can expect to receive your Freelance Tax Number (Steuernummer) within 3-6 weeks of submission.

So that you know exactly what to look out for in the post, here is an example of the letter you will receive from the tax office – your Freelance Tax Number will be detailed in the letter (shown in red box):

Once you have received your Freelance Tax Number (Steuernummer), you are all set and can start invoicing your clients.

For further information on freelancing in Germany, see our guides on How to Set Up as a Freiberufler in Berlin and How to Operate as a Freelancer in Germany.

I hope you have found this guide helpful with distinguishing and understanding the difference between a German tax ID (Steueridentifikationsnummer) and a freelance tax number (Steuernummer).

If you are looking to move to Berlin and would like some information and guidance, then check out our free relocation guides and resources on our homepage.