German Church Tax (Kirchensteuer): What Is It and Do I Need to Pay?

This page takes a look at church tax in Germany, known locally as ‘Kirchensteuer’. Many newcomers to Germany are unaware of this tax until they suddenly notice a hole in their paycheque – in this post, we take a look at what church tax is and who is liable for paying it.

What is church tax (Kirchensteuer)?

Newcomers to Germany are often surprised when they unwittingly find themselves subject to church tax (Kirchensteuer) in Germany. In short, Protestant, Catholic and Jewish denominations have the authority to impose a church tax on its members, which is automatically drawn from your monthly salary if you have indicated that you are a church member.

When it comes to church tax in Germany, your local tax office (Finanzamt) doubles up as the collection agency. Depending on where you are living in Germany, the Finanzamt will withhold an additional 8–9% of your income tax, which will be funnelled through to your respective denomination.

Over time, this figure stacks up and you’ll likely find yourself paying a decent chunk of change in Kirchensteuer per year. To find out exactly how much you’re paying, check the line on your paycheque that is titled ‘KS’. Alternatively, if you want a projection of how much Kirchensteuer you’ll likely be paying in years to come, use this handy church tax calculator.

Who needs to pay church tax (Kirchensteuer) in Germany?

In short, if you declare that you are of Roman Catholic, Protestant or Jewish faith when completing your address registration (Anmeldung) in Germany, then you will be signed up for Kirchensteuer.

While you may have never attended church in Germany or even practice a particular faith, religion is sometimes rooted in cultural identity. As such, lots of people indicate a religion when completing their address registration, unaware that this will mean them paying an additional 8–9% of their income tax to the church.

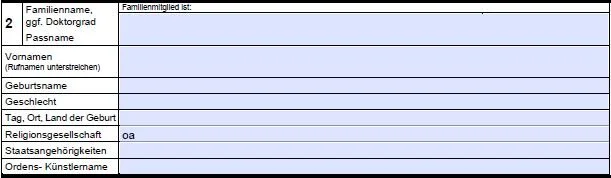

To avoid church tax in Germany, you should specify that you are not a member of a church when completing your Anmeldung. To do this, simply enter ‘oa’ in the section of the form that asks about your ‘Religionsgesellschaft’:

Here ‘oa’ stands for 'keiner öffentlich-rechtlichen Religionsgesellschaft angehörig'. This loosely translates as 'not a member of a public religious society'. This is all it takes for notifying the relevant Berlin authorities that you are not part of a religious community and therefore won't be subject to church tax. You don't need to notify the German state further about this.

If, on the other hand, you wish to declare your religious affiliations (and therefore be subject to church tax), then you can add the following abbreviations to the ‘Religionsgesellschaft’ field:

ev = Evangelical (Evangelisch-lutherische)

rf = Reformed (Reformierte Kirche)

rk = Roman Catholic (Römisch-katholische)

ak = Old Catholic (Altkatholische)

is = Jewish (Jüdische Gemeinde)

I’ve mistakenly signed up for German church tax. Is this permanent?

If you have already completed your address registration before reading this and have declared that you are a member of a Catholic, Protestant or Jewish church, then there is still a way for you to avoid the church tax, although this is significantly more bureaucratic. To do this, you rather dramatically have to leave the church, a process known as Kirchenaustritt.

In Germany, renouncing your church membership costs around €30 and can be done at your local administrative court or registry office (Amtsgericht or Standesamt). You are required to bring your address registration certificate (Anmeldebestätigung) and your passport. You will be issued a document called a Kirchenaustrittsbescheinigung, which serves as proof that you have left the church. Note: if married, also remember to bring along your marriage certificate.

Once completed, your church tax payments will stop being taken from your salary, although there may be a one-month or two-month delay while this is processed.

You can find out further details about leaving the church as well as where your local administrative court is here.

While declaring that you are not a member of a church or renouncing your church membership does not prevent you from attending church services, it is possible that you won't be able to be baptised or married in a German church.

Are there any additional steps for freelancers?

If you are a regular employee in Germany, then the information above should be all that is required for you to declare or renounce your church membership. However, if you are a freelancer, then you’ll also need to declare your religious affiliation when setting up as a Freiberufler.

Specifically, you will need to specify your religious affiliation when applying for your freelance tax number (Steuernummer) at your local tax office (Finanzamt). When completing the Fragebogen zur steuerlichen Erfassung form (needed for becoming a freelancer in Germany), enter your religious affiliation where requested:

If not subject to church tax, enter ‘VD’ in the relevant section.

I hope this page has given you a good overview of church tax (Kirchensteuer) in Germany. For further information and guidance about moving to Germany, explore our relocation guides and resources on our homepage.