Sozialversicherungsnummer: What Is It and How Can I Get My Number?

This page details everything you need to know about the German Sozialversicherungsnummer, commonly known as the German social insurance number. Here you can find out what the number is, why it’s important and how you can get hold of yours!

What is the Sozialversicherungsnummer?

When starting a job in Germany, your employer will need a number of documents from you, one of which is your Sozialversicherungsnummer.

Commonly referred to as the Rentenversicherungsnummer (RNVR), German social insurance number or pension insurance number, your Sozialversicherungsnummer is used to identify that you are paying into the German social security system.

In short, when working as an employee in Germany, you are required to make mandatory pension contributions, which are automatically drawn from your monthly salary. Without your Sozialversicherungsnummer, your employer will not be able to process these contributions or, more importantly, your paycheck. Therefore, it’s really important that you get hold of this number prior to your first payroll!

While crucial when starting work in Germany, other uses for your Sozialversicherungsnummer include claiming benefits and withdrawing your pension.

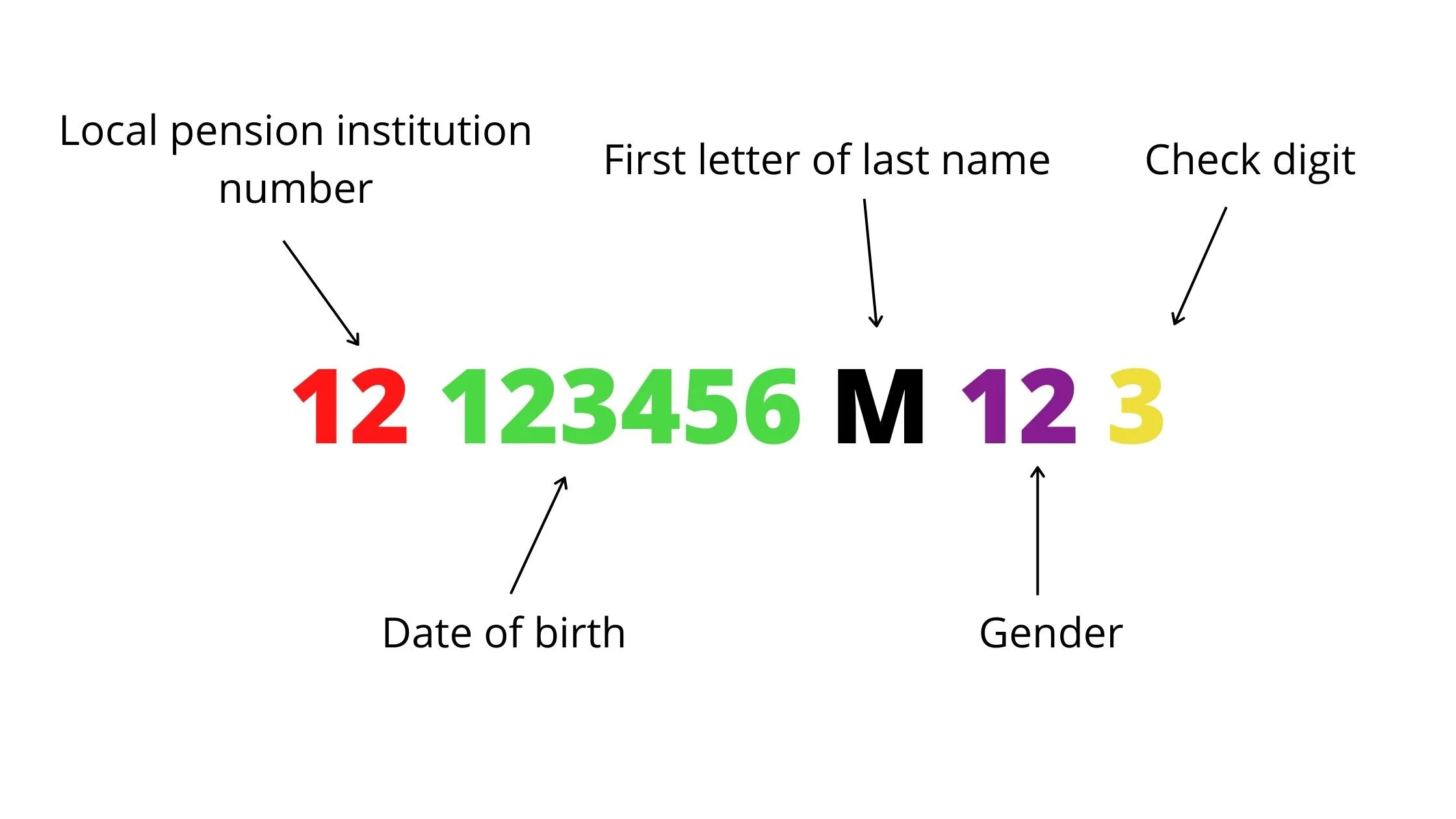

The number itself is made up of 1 number and 11 digits as shown in the image below:

How do I get my Sozialversicherungsnummer in Germany?

To get your German social insurance number, you have a couple of options:

Option 1: Wait for it to arrive in the post

When starting work in Germany, you’ll be enrolled in the German social security system by your employer. As mentioned above, your employer needs to do this in order to process your mandatory pension contributions.

Once enrolled by your employer, your Sozialversicherungsnummer will be generated by Deutsche Rentenversicherung (the German public pension fund) and sent to your registered address in Germany. It generally takes 4–6 weeks to receive this in the post.

Due to the 4–6 week timeframe for receiving your social insurance number in the post, people often aren’t able to provide their employer with their Sozialversicherungsnummer prior to their first payroll. To avoid this, you can opt for option 2 instead…

Option 2: Request your Sozialversicherungsnummer from your German public health insurer

When starting work in Germany, it is mandatory that you take out German health insurance. For most regular employees in Germany, this will be German public health insurance – for this, our favourite choice is TK insurance, a leading public health insurer that is well suited to expats starting work in Germany.

If you sign up for TK insurance via this link, your Sozialversicherungsnummer can be sent to you just 24 hours after your coverage is confirmed. This means you can get your all-important social insurance number from your health insurance provider in a matter of days, rather than tediously waiting for it to arrive in the post (as in option 1 above).

For further information about the benefits of TK insurance, check out our 6 reasons why TK is a good choice for expats in Germany.

Other documents required to start a job in Germany

As detailed above, it’s important that you get hold of your Sozialversicherungsnummer prior to starting work in Germany. However, this isn’t the only document you’ll need to show your new employer. In almost all cases, you’ll also be required to provide:

German tax ID (Steueridentifikationsnummer)

This will automatically be mailed to approximately 2–4 weeks after you register at an address (Anmeldung) in Germany.German health insurance certificate

When working for an employer in Germany, it’s mandatory that you sign up for German health insurance. In the same way that your employer needs your social insurance number (Sozialversicherungsnummer) to process your pension contributions, they also need your German health insurance details to process your monthly health insurance contributions.For German public health insurance, our favourite choice is TK health insurance.

Valid work visa for Germany

If you are non-EU/EEA citizen, you’ll need a visa to start working in Germany. This may be a Work Visa, EU Blue Card or Working Holiday Visa. To explore your options, check out our free visa guides.

German bank details

Most German employers require that you have German bank details in order to process your salary. If you are needing to set up a German account, we suggest checking out N26, Vivid and bunq, three modern online banks that are perfectly suited to expats in Germany.

Follow the link for more detailed information about the documents you require to start a job in Germany.

If you are thinking of moving to Berlin, check out our free relocation guides and resources on our homepage.