Deutsche Kreditbank: How to Sign Up for a DKB Bank Account in English

This page looks at how to open a Deutsche Kreditbank (DKB) account, a popular and free online bank used by over 4.5 million German citizens and residents. We take a quick look at why DKB might be the right banking solution for you and provide a step-by-step guide for navigating the German sign-up process for opening a DKB bank account

In the world of online banking, Deutsche Kreditbank (DKB) was a pioneer. Launched as the first internet bank without branches in 2000, DKB is the forerunner to much more recent online challenger banks such as N26, Vivid and bunq. With age comes stability – while many of its competitors are burgeoning start-ups, DKB is well-established in the German banking sector and combines an affordable (free!) product with solid functionality that will meet most of your day-to-day banking needs.

Key Features of a DKB Bank Account

Free to set up and maintain

If interested in a DKB bank account, a chief benefit to consider is that it is completely free to set up and maintain. There is no sign-up fee and no ongoing management fees for keeping the account open.

There is also no minimum amount that you need to deposit into your DKB account. However, DKB offers numerous additional benefits if you have at least €700 a month coming into your account, which is the threshold for being classified as an Aktivkund (Active Customer).

Free DKB Visa Debit Card

On top of the fact that it is free to set up and maintain, Deutsche Kreditbank’s standard account comes with a free Visa debit card. This covers you for all eventualities, whether you are making POS purchases, withdrawing cash or making purchases online.

For a small monthly fee, you can also receive a DKB Visa credit card and EC card (EC-Karte/Girokarte).

Free worldwide ATM withdrawals

You are likely picking up a theme here; most features associated with a DKB bank account are completely free! And this includes unlimited free ATM withdrawals in euros, whether in Germany or the EU.

This is a rarity in Germany with DKB’s competitors either offering a limited amount of free withdrawals per month (e.g. N26, Vivid or bunq) or only offering free withdrawals from affiliated ATMs (e.g. Commerzbank or Deutsche Bank).

There are also no additional fees if you are an Aktivkund (Active Customer) and withdrawing or paying in a different currency than euros.

DKB and Apple Pay / Google Pay

DKB is fully integrated with Apple Pay and Google Pay, which allows you to securely make payments directly with your phone, watch or tablet.

Main drawbacks of a DKB account

As you will see from the list above, DKB’s appeal is largely down to the fact that it is a free product with free services. While kind on the wallet, DKB still has a number of disadvantages, some of which are highlighted below:

No English customer support

DKB is a favourite amongst Germans, which is why many expats and non-German speakers will be exposed to the ‘DKB vs N26’ debate while living in Germany. In this debate, the key thing to consider is that DKB is solely in German – whether you are calling their customer line or using their online services.

If you do not have a reasonable understanding of German, then I think this will likely be a deal-breaker. While DKB’s online functionality is relatively intuitive and you can get by with Google Translate, it is a hard sell when compared with the more expat-friendly, multilingual support offered by the likes of N26, Vivid and bunq.

There are no DKB branches

If you are looking for a free day-to-day transactional account, then DKB fits the bill. However, it is important to be aware that DKB is 100% online. There is no in-person support and no branches.

If you have more complex banking needs or would like advice on savings, investments, loans, mortgages, etc., then you may feel more comfortable with a traditional ‘bricks-and-mortar’ bank such as Deutsche Bank or Commerzbank.

You may not be accepted

Even if you decide that Deutsche Kreditbank (DKB) is the bank for you, you may have the decision taken out of your hands. In fact, it is estimated that over 50% of sign-ups are rejected – DKB generally do not provide reasons for the rejection, but this is often down to:

A bad or insufficient credit rating

Your employment status, especially if a freelancer or self-employed

A low salary

How to sign up for a DKB account in English

Once you have weighed up the pros and cons of a DKB account and decided whether it is for you, the next step is to complete the online sign-up process. Click the link to access DKB’s online registration form.

Below, you will find a step-by-step English guide to completing the DKB sign-up form as it is only available in German. We have auto-translated the different pages of the form using the Google Translate Chrome Extension and added in some annotations in fields where the machine translation is not all that clear. When signing up, we recommend either using the Google Translate Chrome Extension yourself or referring back to this guide.

1. Open the DKB sign-up form

Access the form via the ‘Open DKB-Cash now’ button. In German, this will say ‘Jetzt DKB-Cash eröffnen’:

2. Enter your personal details

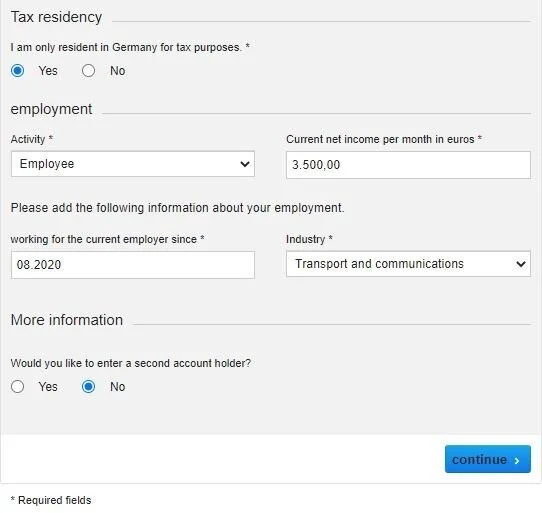

For ‘Housing status’, DKB is requesting information on the property type that you live in, i.e. do you own your home or are you in a rental property.

For your ‘Tax residency’, DKB is asking if you are exclusively a tax resident in Germany.

3. Accept DKB’s data protection terms and conditions

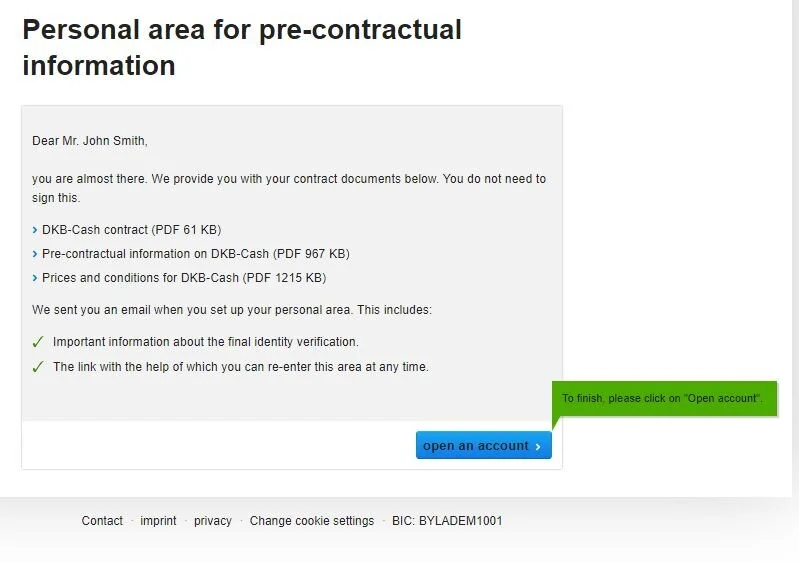

Once you have completed the form with your personal details, you will be shown a full screen of terms and conditions. Once you have received and accepted these Ts and Cs, you will see a summary of your data.

4. Hit ‘open an account’ and move on to the ID verification step

5. Verify your ID

Once you have submitted the application form to DKB, you will receive an email with instructions for verifying your identity – after all, a bank needs to verify that you are who you say you are.

With DKB, you can complete your verification online via WebID, which is a video verification service. For the call, you will just need:

a computer, tablet or smartphone with a webcam and microphone

a valid ID document or passport

your reference number (which will be included in the email you receive from DKB)

To initiate the verification, click on the ‘Jetzt legitimieren’ button in the email:

On the call, a verification agent will confirm a number of details with you and do some routine security checks. The call generally lasts around 5 minutes.

Alternatively, DKB also attaches a POSTIDENT coupon to the email you receive. You can use this coupon to verify your identity in person at a Deutsche Post branch in Germany.

If successful with the verification process, you will then receive your account documents and bank cards in the post – congratulations! If you have reached this stage, you are now a DKB customer and account holder.

I hope you have found this guide helpful! If you are interested in signing up for a DKB account, then this can be done here.

For further information about living in Germany, check out our other blog posts and free relocation resources.