bunq Review and How to Open an Account

This page is a comprehensive review of bunq, a mobile bank account that is quickly establishing itself in the European consumer banking sector. In this review, we’ll cover bunq’s main features, the pros and cons of their accounts and instructions on how to sign up if you think bunq is the bank for you!

bunq Review: An Overview

bunq is a modern, slick online bank that has been rapidly gaining a foothold in Europe’s retail banking sector, especially among expats living across the continent. Initially released to the Dutch public in 2015, bunq is now available across the entire EU. It is widely recognised as one of the main challenger banks alongside N26 and Vivid. With a wide range of useful features, a fantastic mobile app and English-speaking customer support, it seems just a matter of time before bunq becomes omnipresent in most European markets.

bunq describes itself as the ‘bank of The Free’ and has a simple philosophy based on customer choice (your money, your rules), security and transparency. As an example of its socially-oriented approach, the bank promises to never sell your data and will let you, the customer, determine if and when your money is invested.

This refreshing approach, when coupled with a great user experience, sets bunq apart from more established players that have shadier money-making practices.

bunq Review: What We Love

As with any bank, there are going to be some drawbacks. But with bunq, we are happy to say that the pros far outnumber the cons. Here is an overview of the things we love about bunq:

It is available in 27 European countries

You can sign up for a bunq account whether you live in Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Lichtenstein, Luxembourg, Malta, the Netherlands, Norway, Portugal, Romania, Slovakia, Slovenia, Spain or Sweden.

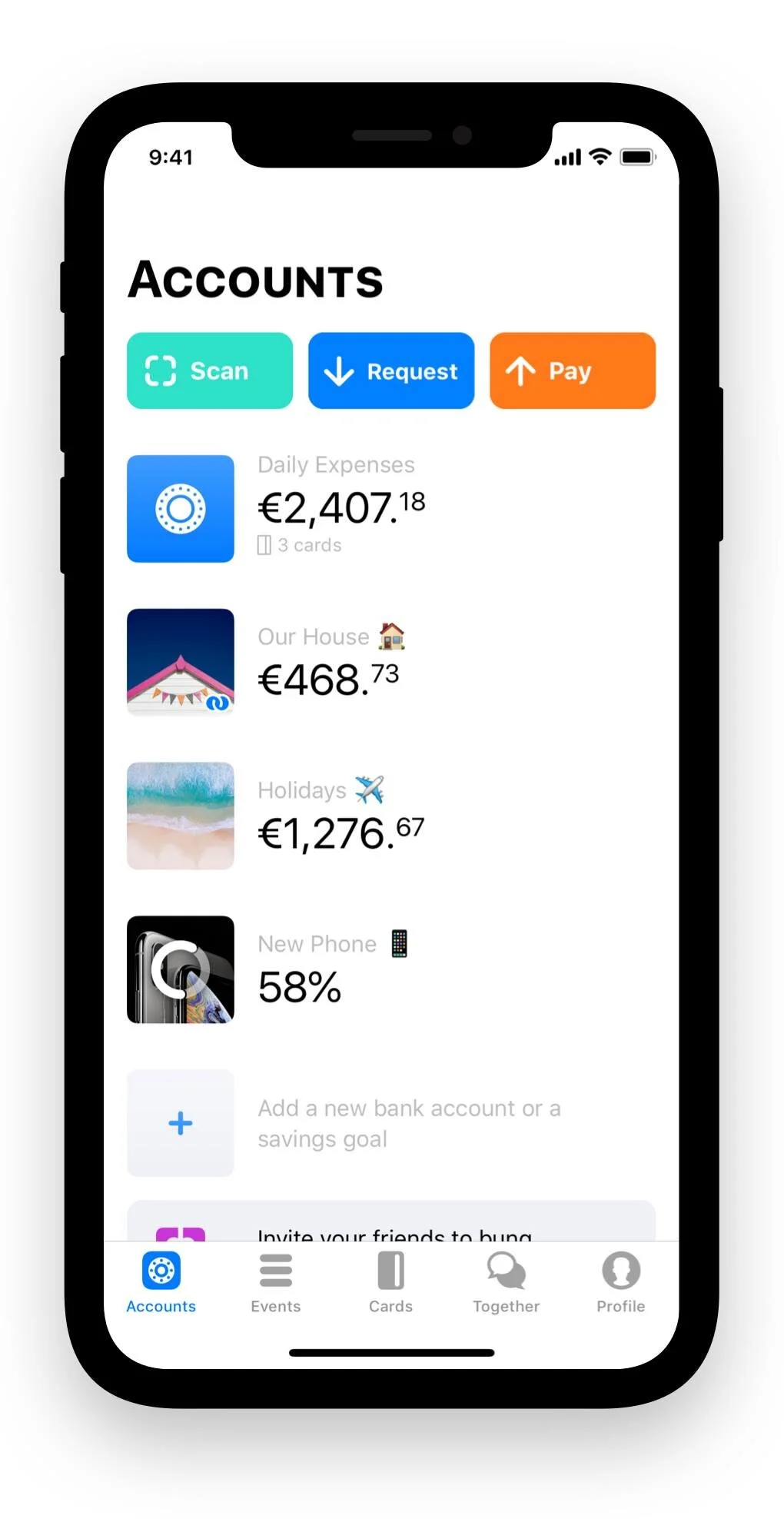

You manage all your banking via bunq’s extremely slick mobile app

You get up to 6 free global ATM withdrawals per month

With many European banks only offering free withdrawals from designated ATMs and the likes of N26 only providing 3–5 free ATM withdrawals per month, up to 6 free global withdrawals with bunq is quite appealing if you are someone who uses lots of cash.

You can get both a Debit Mastercard and Maestro

A Maestro card is especially useful if living in the likes of Germany and the Netherlands. When coupled with a Debit Mastercard, this will give you all the flexibility you need from your day-to-day bank, whether you wish to make online purchases, withdraw cash or pay for a product in a store.

Wise (formerly TransferWise) is integrated into the app

Through integrating Wise, bunq offers great rates for international transfers and payments and a highly intuitive transfer process. Sending money through Wise is estimated to be 8x cheaper than traditional methods so this is a real bonus for anyone who is living overseas.

You can open 25 sub-accounts, each with separate IBANs

Depending on how you like to manage your money, having up to 25 sub-accounts is a great way to budget and have a clear picture of your finances. For example, you can split your funds into day-to-day costs, rent, utilities, entertainment, etc.

They support 6 languages

When it comes to your money, it’s important that you can easily manage your account and rectify any issues in a language that you understand.

For this, bunq offers services and support in English, Dutch, French, Italian, German and Spanish. On top of this, bunq has a really unique user community (bunq Together) that is a great resource for all users.

The simplest of sign-up processes

To sign up for a bunq account, all you require is a phone, your address and a supported ID. The process is entirely online and usually takes less than 5 minutes, which is a much nicer experience than queuing up at a local bank branch! For further details about how to sign up, see below.

bunq Review: What We Don’t Love

While none of the drawbacks are significant, these are a few of the things that should be weighed up when contemplating a bunq account.

It’s not free

While not completely free, bunq currently offers a plan from just €2.99 per month. While still quite a low monthly fee, a similar account with N26 or Vivid will cost you absolutely nothing.

There are no branches

While having all your banking services on your phone is seen as a positive by many, some people prefer being able to walk into a physical branch to discuss and arrange their finances. If this is you, or if you have more complex banking needs, then the online nature of bunq may be considered a drawback.

bunq Review: Summary

There is no doubt that bunq has fairly lofty ambitions when it comes to disrupting the European banking sector. But these ambitions are being backed up by a really solid product, a strong brand and community, and very few faults to pick apart.

All in all, bunq is widely enjoyed by a vast majority of its users. It’s slick interface and usability, when coupled with functionality that is geared towards international, transient lifestyles, has made it a firm favourite for young people across Europe.

To sign up for a bunq account, follow this link or use our sign-up instructions below.

Can I sign up for a bunq account?

Before looking at the simple steps for signing up for a bunq account, it’s important to confirm that you are actually eligible for an account. To be eligible, you must:

Be a resident of the EU/EEA

Have a valid identity document (see details below)

Be at least 18 years old

Have a device with the following minimum specifications:

iOS (11.3+)

Android (Lollipop 5.0+)

What does bunq consider a valid ID?

What is considered a valid ID is dependent on where you are from. We’ve broken down the different categories below:

If you are from an EU/EEA member state, then you can verify your identity using a:

Passport

EU driving license

ID Card

Residence Permit

If you not from an EU/EEA member state, then you can verify yourself with your passport if you are from a country on the following list:

Argentina, Australia, Brazil, Canada, Chile, China, Colombia, Ecuador, Hong Kong, Indonesia, India, Israel, Japan, South Korea, Mexico, Morocco, Malaysia, New Zealand, Peru, Russia, Singapore, Switzerland, South Africa, Turkey, Ukraine, United States, Uruguay, Venezuela, Vietnam.

If you are from a non-EU country not listed above, then you must have a residence permit to sign up for a bunq account.

How do I sign up for a bunq account?

Now that you know you’re eligible for a bunq account and have your valid ID at the ready, it’s time to open an account on your mobile device:

If on a desktop or laptop, enter your phone number on the screen that opens. You’ll then be prompted to download the bunq mobile app.

Click on the explore button (+) and select personal account.

Enter your personal details.

Set up security.

Insert your residential information.

Scan your ID document.

Bunq will then check your application and contact you once your account is ready to be used.